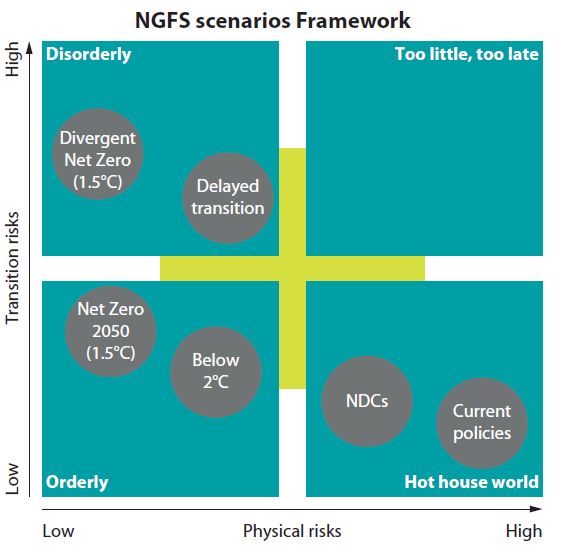

“Climate scenarios are a crucial tool in assessing the risks of the future,” says Sarah Breeden, Executive Director at the Bank of England and chair of the scenario process within the Network for Greening the Financial System (NGFS). “But they are so much more. Because when we better understand the risks of tomorrow, we take more informed action today, and in doing so support an orderly transition to net zero.”

For an orderly transition towards net zero emissions by mid century, investments into renewable energy would have to double to quadruple in the next ten years compared to continuing current trends, according to the scenarios. This offers remarkable investment opportunities. In turn, investments into fossil energy would substantially decrease. To enable an orderly transition, computer simulations show a carbon price is needed in the range of 100-200 US dollar per tonne CO2 by 2030. The analysis assumes that the revenue is returned to the economy through a mix of government investments, debt paydown and tax cuts.

CO2 price in the range of 100-200 US dollar by 2030

"Both climate change and finance are all about global risks”, says Elmar Kriegler from the Potsdam Institute for Climate Impact Research (PIK). “Connecting scenarios developed by climate researchers with the financial institutions' expertise is a huge step forward to coordinate thinking about the economic implications of ambitious climate policy or the lack thereof. It is a step that can ultimately lead us to effectively limit the risks and help achieve a safe future for all."

Kriegler is coordinating the academic consortium that developed the scenarios with the NGFS. It includes the International Institute for Applied Systems Analysis (IIASA), University of Maryland (UMD), Climate Analytics (CA), the Swiss Federal Institute of Technology in Zurich (ETHZ), and the National Institute of Economic and Social Research (NIESR). This work was made possible by grants from Bloomberg Philanthropies and ClimateWorks Foundation. The financial institutions involved in the NGFS include the central banks of Great Britain, France, Germany, the EU, U.S., Japan, China, Brazil, India, Russia as well as observers such as the International Monetary Fund and the World Bank.

More info

Interactive introduction to the NGFS scenarios: https://www.ngfs.net/ngfs-scenarios-portal/

Press release by NGFS: https://www.ngfs.net/en/communique-de-presse/ngfs-publishes-second-vintage-climate-scenarios-forward-looking-climate-risks-assessment

Presentation of the NGFS scenarios:

https://www.ngfs.net/sites/default/files/medias/documents/ngfs_climate_scenarios_phase2_june2021.pdf

Data

Transition risk and macro-economic data via the NGFS IIASA Scenario Explorer:

https://data.ene.iiasa.ac.at/ngfs/

Physical risk data via the NGFS CA Climate Impact Explorer:

http://climate-impact-explorer.climateanalytics.org/impacts/

Technical documentation of the NGFS scenarios:

https://www.ngfs.net/sites/default/files/ngfs_climate_scenarios_technical_documentation__phase2_june2021.pdf

Contact:

PIK press office

Phone: +49 331 288 25 07

E-Mail: press@pik-potsdam.de

Twitter: PIK_Climate

www.pik-potsdam.de