Substituting utility maximization in economic modelling with behaviorally grounded decision making

“We substitute utility maximization in economic modelling with behaviorally grounded decision making to provide a different perspective on problems such as economic growth,” says Jakob Kolb, a former PhD student at the Potsdam Institute for Climate Impact Research (PIK) and one of the authors of the study now published in the Proceedings of the US National Academy of Sciences (PNAS). “Though the model we use is quite simple, it shows how we miss key insights into important economic phenomena if we model humans as rational decision-making machines rather than as deeply social beings.”

In fact, the model makes the prediction that during recessions, saving rates increase before output rises – which fits observations for private savings in 19 OECD countries. “Hence, our approach seems to be quite realistic in this respect,” says co-author Jobst Heitzig from PIK. “Next, we will use the social dynamics we analyzed here to model the re-allocation of capital from non-sustainable, CO2 intensive economic activities to more sustainable investments.”

The researchers observed that when the social dynamics gets faster in their model, the inequality between households can very suddenly disappear, but if households copy their friends all too quickly, they might learn the wrong thing and stop saving altogether.

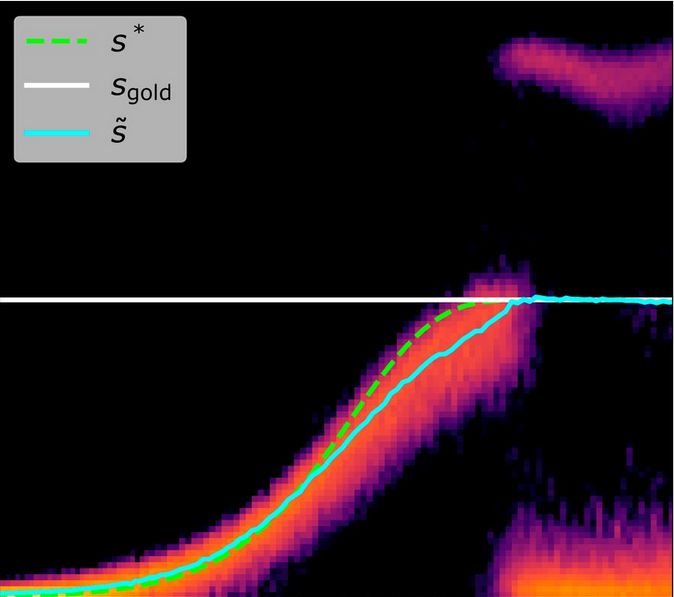

The picture of a man balancing a pole on his hand

The authors use the picture of man balancing a pole on his hand to illustrate the difference between their new model and older, conventional ones. “A standard macroeconomic model would posit that the man is a perfect pole balancer, and any deviations in the angle must be driven by external shocks, such as sharp gusts of wind,” says co-author J. Doyne Farmer, Director of Complexity Economics at the Institute for New Economic Thinking, Oxford University. “On this view, after each shock the man moves his hand perfectly to make the pole vertical again but, before he can achieve this, another shock strikes, making the pole wobble. It is clear this explanation is wrong; theories that assume some of the pole’s wobbles are due to the man’s imperfect ability to balance the pole provide a far better explanation.”

The study is also an example of successful promotion of young talent. Its first author Yuki Asano developed the model and found the main results during his Bachelor thesis work at PIK, supervised by Jakob Kolb and Jobst Heitzig. Asano then moved on to do his PhD at Oxford University where the writing of the paper gained the support of Doyne Farmer, a pioneer of chaos theory who also spent a few years at PIK in the 2010s.

Article

Yuki M. Asano, Jakob J. Kolb, Jobst Heitzig, J. Doyne Farmer (2021): Emergent inequality and business cycles in a simple behavioral macroeconomic model. Proceedings of the National Academy of Sciences (PNAS) [DOI:10.1073/pnas.2025721118]

Weblink to the article

https://www.pnas.org/content/118/27/e2025721118/tab-article-info

Contact:

PIK press office

Phone: +49 331 288 25 07

E-Mail: press@pik-potsdam.de

Twitter: PIK_Climate

www.pik-potsdam.de